For example, a CM ratio of 40% means that for each dollar of sales, the company has $0.40 left after covering variable costs to pay fixed costs and make a profit. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.

What does a high or low Contribution Margin Ratio mean for a business?

The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). Investors examine contribution margins to determine if a company is using its revenue effectively. A high contribution margin indicates that a company tends to bring in more money than it spends.

When to Use Contribution Margin Analysis

For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s. Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues.

Get in Touch With a Financial Advisor

Remember, that the contribution margin remains unchanged on a per-unit basis. Whereas, your net profit may change with the change in the level of output. As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently. These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. Let’s look at an example of how to use the contribution margin ratio formula in practice.

- If they send one to eight participants, the fixed cost for the van would be \(\$200\).

- The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal.

- Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income.

How does the contribution margin affect profit?

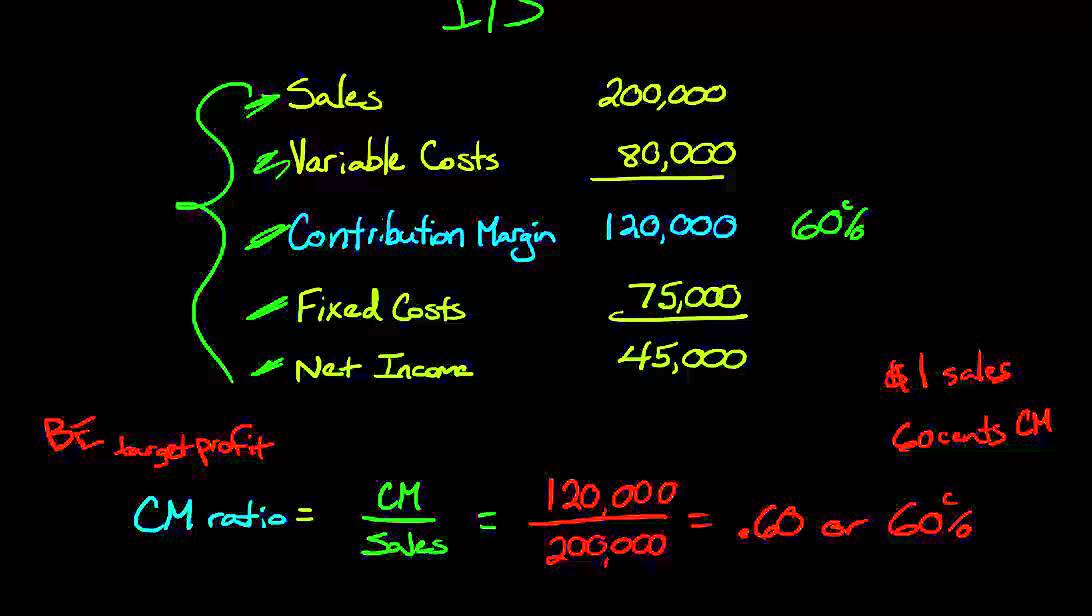

In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000. Remember, the per-unit variable cost of producing a single unit of your product in a particular production schedule remains constant. The contribution margin income statement separates the fixed and variables costs on the face of the income statement.

The Evolution of Cost-Volume-Profit Relationships

Such an analysis would help you to undertake better decisions regarding where and how to sell your products. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point.

The calculator will not only calculate the margin itself but will also return the contribution margin ratio. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit. Contribution margin analysis also helps companies measure their operating leverage. Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage.

Alternatively, it can also be calculated by multiplying the Contribution Margin Per Unit by the total quantity of units sold. Furthermore, a contribution margin tells you how much extra revenue you make by creating additional units after reaching your break-even point. Below is a breakdown of contribution margins in detail, including how to calculate them. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin.

For example, if a company sells a product that has a positive contribution margin, the product is making enough money to cover its share of fixed costs for the company. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales. On top of that, contribution margins help you determine the selling price range for a product or the possible prices at which you can sell that product wisely. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit. To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue.

The benefit of expressing the contribution margin as a percentage is that it allows you to more easily compare which products are the most valuable to your business. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Alternatively, the company can also try finding ways to improve revenues. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business. These examples demonstrate how this concept credit policy is applicable across a wide range of industries and can be an essential tool in pricing decisions, cost control, and profitability analysis. Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line. Still, of course, this is just one of the critical financial metrics you need to master as a business owner.